CMS Work Opportunity Tax Credit Newsletter December 2022

In this issue:

- WOTC In The News Roundup 2022

- Why Switch to a Paperless WOTC Screening Process

- CMS Pin Point WOTC Technology (CPPT)

- Expiring POAs

- WOTC Wednesday: How Long Must an Eligible Employee Work Before You Receive a WOTC Tax Credit?

- Understanding WOTC’s Target Groups: Qualified Long-Term Unemployment Recipient

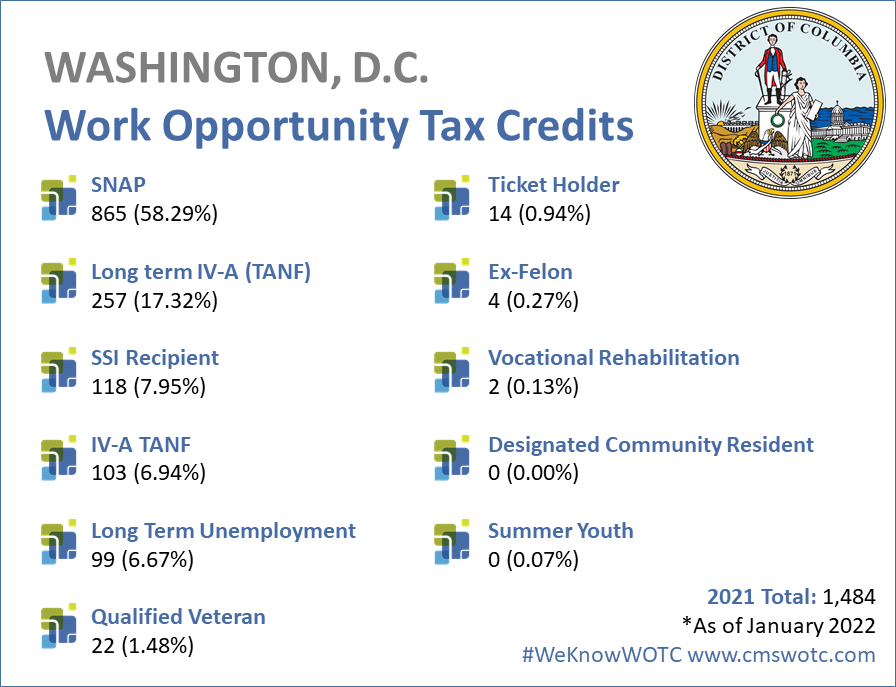

- Work Opportunity Tax Credit Statistics for Washington

- Make the Switch To Paperless WOTC Screening

- #ICYMI

- CMS Celebrated 25th Anniversary in 2022!

WOTC In The News Roundup 2022

A look back at a roundup of recent news stories related to the Work Opportunity Tax Credit throughout 2022.

Why Switch to a Paperless WOTC Screening Process

CMS’s online web link screening system screens your WOTC new hires with ease. The benefits of using the online screening system include…

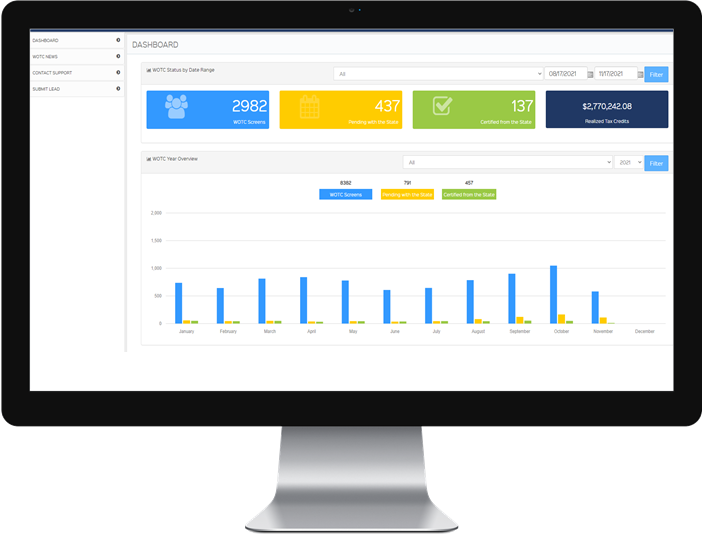

CMS Pin Point WOTC Technology (CPPT)

CMS’s Pin Point WOTC Technology (CPPT) performs a multi-step process to detect, identify and confirm new hires living in Federal Empowerment Zones and Rural Renewal Communities. CMS provides another technology tool designed to maximize the federal tax credit program for our clients.

POA Forms Expiring at End of Year

If your Power of Attorney (POA) document for the Work Opportunity Tax Credit is expiring at the end of 2022, Lisa and Sean will be reaching out to you to renew over the next few weeks with a new one. If you have any questions or concerns, please contact us at 800-517-9099.

WOTC Wednesday: How Long Must an Eligible Employee Work Before You Receive a WOTC Tax Credit?

CMS’s Brian Kelly answers your questions about the Work Opportunity Tax Credit in our weekly video Q&A series #WOTCWednesday.

Other Recent #WOTCWednesday Questions Answered:

- Are We Eligible for Employees Who Continue to Receive SNAP Benefits While Working?

- How Are WOTC Tax Credits Calculated?

- What Are the WOTC Screening Options That CMS Offers?

Submit your question for Brian here.

Understanding WOTC’s Target Groups: Long-Term Unemployment Recipient

New hires who fall under one or more of WOTC’s Target Groups may make you eligible for a WOTC Tax Credit. Target Group #10 is the Long-Term Unemployment Recipient.

233,160 individuals were hired with certification from this group in 2021, 11.20% of the total.

A “qualified long-term unemployment recipient” is an individual who has been unemployed for not less than 27 consecutive weeks at the time of hiring and who received unemployment compensation during some or all of the unemployment period.

The maximum tax credit available for hiring a Long-Term Unemployment Recipient is $2,400.

Texas hired the most Long-Term Unemployment Recipients last year with 55,699 new hires qualifying under that target group.

Work Opportunity Tax Credit Statistics for Washington

In 2021 the state of Washington issued 43,419 Work Opportunity Tax Credit certifications. The Evergreen State issued 2.09% of all WOTC Tax Credits in 2021, SNAP Recipient was Washington’s highest tax credit category with 54.28% of certifications for that target group.

Make the Switch to Paperless WOTC Screening

CMS has been providing Work Opportunity Tax Credit screening services for 25 years. We have helped save employers millions of dollars that can be reinvested back into their businesses. We highly encourage customers to take advantage of the online WOTC screening form that we developed or the call center, both of which provide several benefits to you.

#ICYMI

CMS Celebrated 25th Anniversary in 2022!

CMS celebrated 25 years in business this year! In 1997 Brian Kelly started “CMS” in the HR software and tax credit business, supporting businesses across the New England area. We developed our own software for both tax credits (WOTC) and iRecruit, Applicant Tracking and Remote Hiring Software. Congratulations Brian!

#Follow CMS on Social Media

#WeKnowWOTC

The latest news on the Work Opportunity Tax Credit (WOTC) from Cost Management Services. Sign Up for the Work Opportunity Tax Credit (WOTC) Newsletter

Related: WOTC Newsletter Archive