CMS Work Opportunity Tax Credit Newsletter November 2022

In this issue:

- Where to post job openings to attract Veterans

- Veterans: How To Obtain a Copy of Your DD214 Form

- HR.com Speaks with Brian Kelly About iRecruit, and the Work Opportunity Tax Credit

- POA Forms Expiring at End of Year

- WOTC Wednesday: Do Employers Benefit From Hiring Veterans?

- Understanding WOTC’s Target Groups: Qualified Veteran, Disabled or Unemployed Veteran

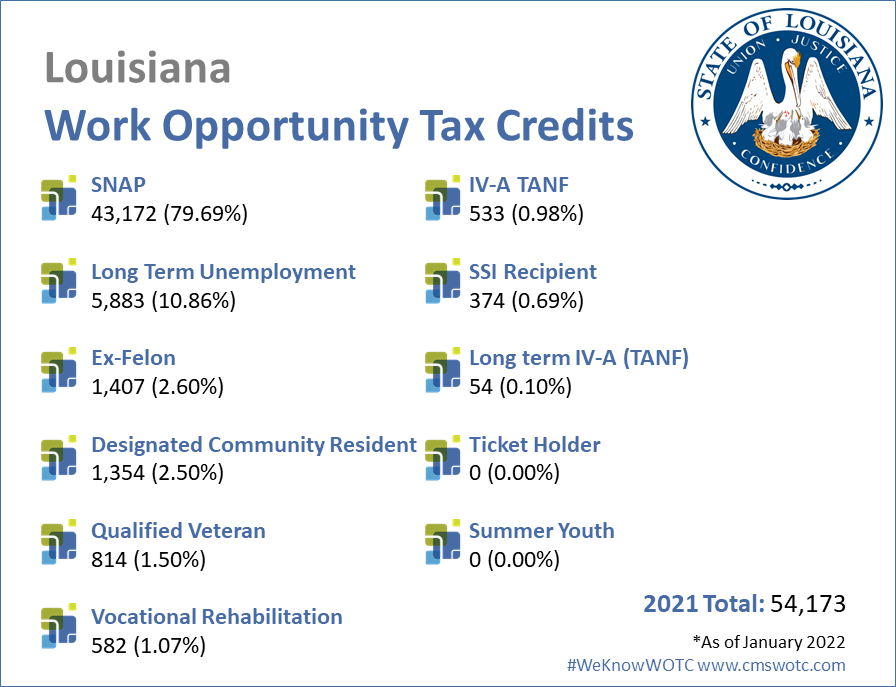

- Work Opportunity Tax Credit Statistics for Louisiana

- Make the Switch To Paperless WOTC Screening

- #ICYMI

Where to post job openings to attract Veterans

According to Monster.com 90% of veterans say finding a veteran-friendly company is critical in their job search. And when you are using the Work Opportunity Tax Credit, you may also be eligible for a tax credit of up to $9,600.

Veterans: How To Obtain a Copy of Your DD214 Form

Qualified Veterans need to provide a copy of their Certificate of Release or Discharge from Active Duty form, known as a DD214.

HR.com Speaks with Brian Kelly About iRecruit, and the Work Opportunity Tax Credit

Brian Kelly speaks with Sue Morton of HR.com to discuss how iRecruit’s unique applicant tracking software facilitates seamless integration AND taps into additional talent pools that give tax service credits using the Work Opportunity Tax Credit.

POA Forms Expiring at End of Year

If your Power of Attorney (POA) document for the Work Opportunity Tax Credit is expiring at the end of 2022, Lisa and Sean will be reaching out to you to renew over the next few weeks with a new one. If you have any questions or concerns, please contact us at 800-517-9099.

WOTC Wednesday: Do Employers Benefit From Hiring Veterans?

CMS’s Brian Kelly answers your questions about the Work Opportunity Tax Credit in our weekly video Q&A series #WOTCWednesday.

Other Recent #WOTCWednesday Questions Answered:

- Can I get a report on how many people were qualified for WOTC?

- Are the WOTC Forms available in Spanish or Portuguese?

- What Are the WOTC Screening Options That CMS Offers?

Submit your question for Brian here.

Understanding WOTC’s Target Groups: Qualified Veteran, Disabled or Unemployed Veteran

New hires who fall under one or more of WOTC’s Target Groups may make you eligible for a WOTC Tax Credit. Target Group #2 is the Qualified Veteran. 101,806 individuals were hired with certification from this group in 2021, 4.89% of the total.

A “qualified veteran” is a veteran who is any of the following:

- A member of a family receiving assistance under the Supplemental Nutrition Assistance Program (SNAP) (food stamps) for at least a 3-month period during the 15-month period ending on the hiring date

- Unemployed for periods of time totaling at least 4 weeks (whether or not consecutive) but less than 6 months in the 1-year period ending on the hiring date

- Unemployed for periods of time totaling at least 6 months (whether or not consecutive) in the 1-year period ending on the hiring date

- Entitled to compensation for a service-connected disability and hired not more than 1 year after being discharged or released from active duty in the U.S. Armed Forces or

- Entitled to compensation for a service-connected disability and unemployed for periods of time totaling at least 6 months (whether or not consecutive) in the 1-year period ending on the hiring date

The maximum tax credit available for hiring a Qualified Veteran is $9,600.

California hired the most Qualified Veterans last year with 9,149 new hires qualifying under that target group.

Work Opportunity Tax Credit Statistics for Louisiana

In 2021 the state of Louisiana issued 54,173 Work Opportunity Tax Credit certifications. The Pelican State issued 2.60% of all WOTC Tax Credits in 2021, SNAP Recipient was Louisiana’s highest tax credit category with 79.69% of certifications for that target group.

Make the Switch to Paperless WOTC Screening

CMS has been providing Work Opportunity Tax Credit screening services for 25 years. We have helped save employers millions of dollars that can be reinvested back into their businesses. We highly encourage customers to take advantage of the online WOTC screening form that we developed or the call center, both of which provide several benefits to you.

#ICYMI

#Follow CMS on Social Media

#WeKnowWOTC

The latest news on the Work Opportunity Tax Credit (WOTC) from Cost Management Services. Sign Up for the Work Opportunity Tax Credit (WOTC) Newsletter

Related: WOTC Newsletter Archive