CMS Work Opportunity Tax Credit Newsletter October 2022

In this issue:

- WOTC In The News Roundup

- Join Us for Fast & Thorough Background Screening with Verified First

- Tips to Maximize WOTC Participation and Increase Savings

- CMS Pin Point WOTC Technology (CPPT)

- WOTC Wednesday: Is it worth it for employers to do the WOTC Tax Credits?

- Understanding WOTC’s Target Groups: Long-Term Family Assistance Recipient

- Work Opportunity Tax Credit Statistics for Mississippi

- Make the Switch To Paperless WOTC Screening

- #ICYMI

WOTC In The News Roundup

This article provides a roundup of recent news stories related to the Work Opportunity Tax Credit.

- IRS Update Clarifies Prescreening Process of New Hires for Work Opportunity Tax Credit

- Long debated tax credit to support hiring of military spouses may finally pass

- How Employers Can Set Formerly Incarcerated Workers Up for Success

- Help wanted? Businesses that are hiring should know about the work opportunity tax credit

Join Us for Fast & Thorough Background Screening with Verified First

We are pleased to invite you to a 45-minute webinar hosted by our partners, Verified First, on October 27th at 1:00 PM ET. They’ll explore how your organization can easily make recruiting and hiring decisions and how to avoid the bad ones.

Tips to Maximize WOTC Participation and Increase Savings

With 25 years of experience in Work Opportunity Tax Credit screening and processing, we would like to offer you some tips to make sure you get the maximum tax credit available.

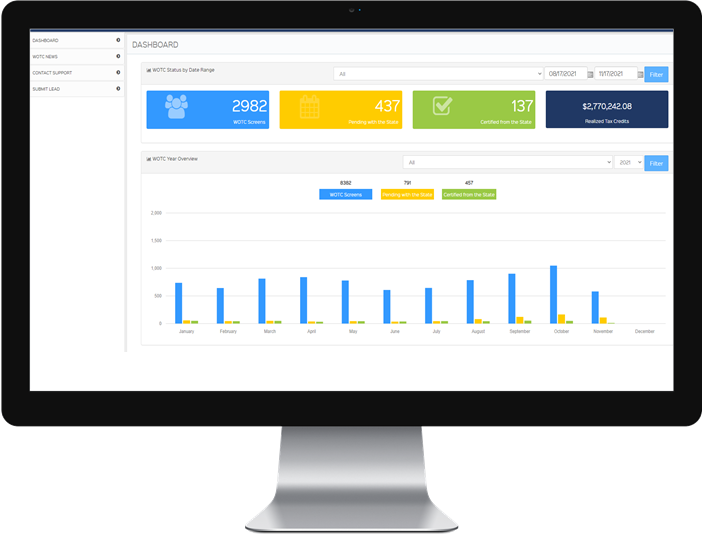

CMS Pin Point WOTC Technology (CPPT)

CMS’s Pin Point WOTC Technology (CPPT) performs a multi-step process to detect, identify and confirm new hires living in Federal Empowerment Zones and Rural Renewal Communities. CMS provides another technology tool designed to maximize the federal tax credit program for our clients.

WOTC Wednesday: Is it worth it for employers to do the WOTC Tax Credits?

CMS’s Brian Kelly answers your questions about the Work Opportunity Tax Credit in our weekly video Q&A series #WOTCWednesday.

Other Recent #WOTCWednesday Questions Answered:

- What is the minimum wage for WOTC?

- Can you do the WOTC Application on a Cell Phone?

- How do I explain to an employee why we are asking if they have received SNAP Benefits?

Submit your question for Brian here.

Understanding WOTC’s Target Groups: Long-Term Family Assistance Recipient

- Received assistance under an IV-A program for a minimum of the prior 18 consecutive months

- Received assistance under an IV-A program for a minimum 18-month period beginning after 8/5/1997 and it has not been more than 2 years since the end of the earliest of such 18-month period or

- Ceased to be eligible for assistance under an IV-A program because a federal or state law limited the maximum time those payments could be made, and it has been not more than 2 years since the cessation of such assistance

The maximum tax credit available for hiring a Long-Term Family Assistance Recipient is $9,000 taken over two years. ($4,000 in first year/40% of $10,000 and $5,000 in second year/50% of $10,000.) California hired the most Long-Term Family Assistance Recipients last year with 13,106 new hires qualifying under that target group.

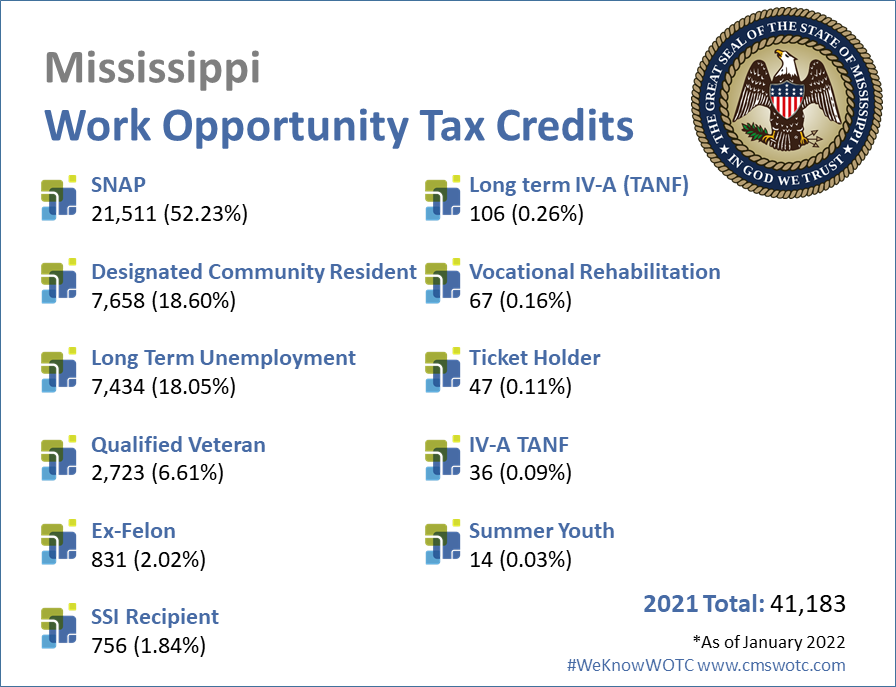

Work Opportunity Tax Credit Statistics for Mississippi

In 2021 the state of Mississippi issued 41,183 Work Opportunity Tax Credit certifications. The Magnolia State issued 1.98% of all WOTC Tax Credits in 2021, SNAP Recipient was Mississippi’s highest tax credit category with 52.23% of certifications for that target group.

Make the Switch to Paperless WOTC Screening

CMS has been providing Work Opportunity Tax Credit screening services for 25 years. We have helped save employers millions of dollars that can be reinvested back into their businesses. We highly encourage customers to take advantage of the online WOTC screening form that we developed or the call center, both of which provide several benefits to you.

#ICYMI

#Follow CMS on Social Media

#WeKnowWOTC

The latest news on the Work Opportunity Tax Credit (WOTC) from Cost Management Services. Sign Up for the Work Opportunity Tax Credit (WOTC) Newsletter

Related: WOTC Newsletter Archive