CMS Work Opportunity Tax Credit Newsletter December 2021

In this issue:

- Expiring POAs

- WOTC In the News: Build Back Better Act Passes in the House

- WOTC Wednesday: Do I Submit the WOTC Forms After the Employee Reaches 120 Hours or Before?

- Understanding WOTC’s Target Groups: Designated Community Resident

- Work Opportunity Tax Credit Statistics for South Carolina

- Make the Switch To Paperless WOTC Screening

- #ICYMI

Expiring POAs

If your Power of Attorney (POA) document for the Work Opportunity Tax Credit is expiring at the end of 2021, Lisa and Sean will be reaching out to you to renew over the next few weeks. If you have any questions or concerns, please contact us at 800-517-9099.

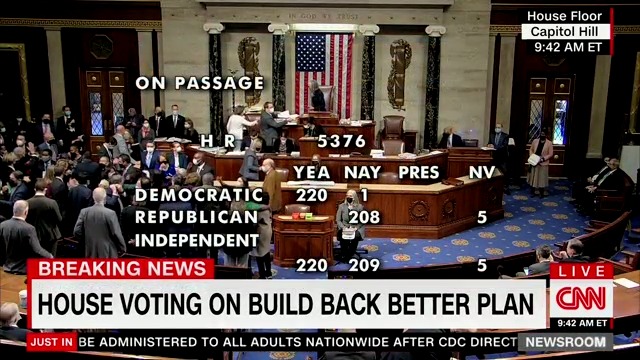

WOTC In the News: ‘Build Back Better Act’ Passes in the House

Huge news, the Build Back Better Act has passed in the House. It now heads to the Senate. Build Back Better includes provisions for the Work Opportunity Tax Credit that would increase the credit amount from $2,400 to $5,000 per qualified individual. In addition, it would allow for rehires to qualify for WOTC during the COVID-19 recovery period through the end of 2022. CMS will be watching this closely, and will alert our customers and partners of any updates as they occur.

WOTC Wednesday: Do I Submit the WOTC Forms After the Employee Reaches 120 Hours or Before?

CMS’s Brian Kelly answers your questions about the Work Opportunity Tax Credit in our weekly video Q&A series #WOTCWednesday.

Other Recent WOTC Questions Answered:

- How Much WOTC Tax Credits Can an Employer Receive for Hiring a Qualified Veteran?

- Do employers benefit from hiring veterans?

- What Is The Minimum Wage An Employee Needs to Receive for My Company To Use the WOTC Tax Credit?

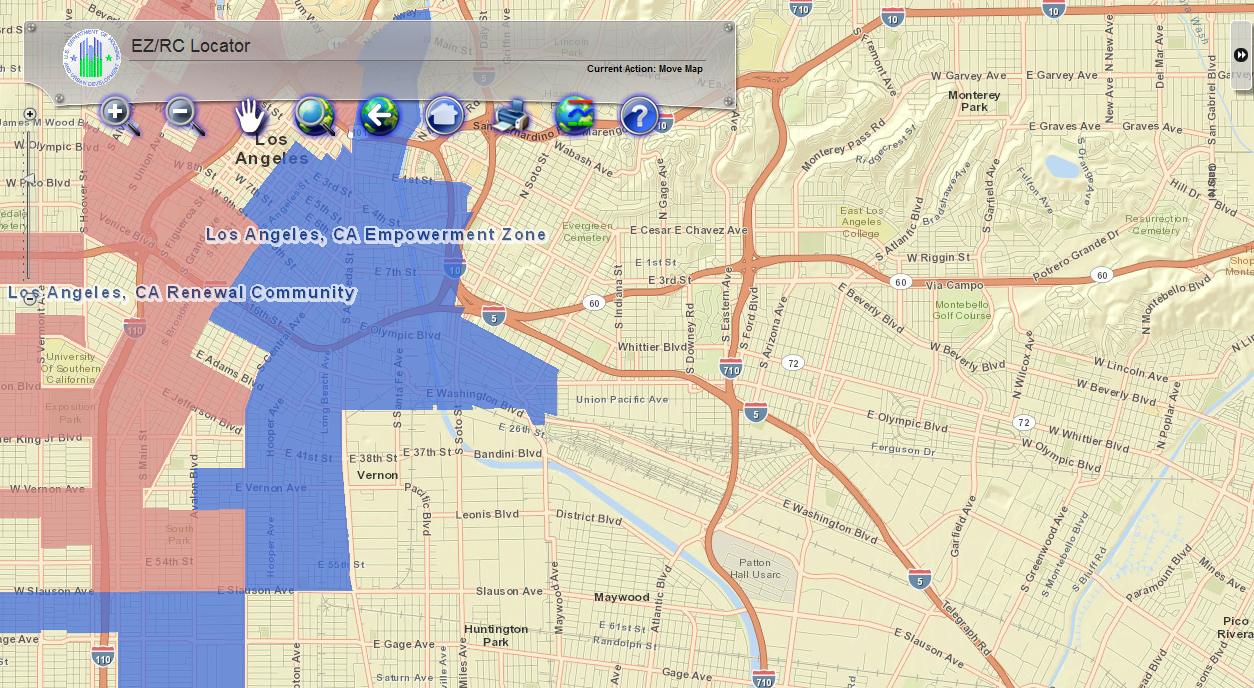

Understanding WOTC’s Target Groups: Designated Community Resident

New hires who fall under one or more of WOTC’s Target Groups may make you eligible for a WOTC Tax Credit. Target Group #4 is the Designated Community Resident. 68,198 individuals were hired with certification from this group in 2020, 4.21% of the total, making it the fourth overall certified category behind SNAP.

A DCR is an individual who, on the date of hiring

- Is at least 18 years old and under 40,

- Resides within one of the following:

- An Empowerment zone

- An Enterprise community

- A Renewal community

- AND continues to reside at the locations after employment.

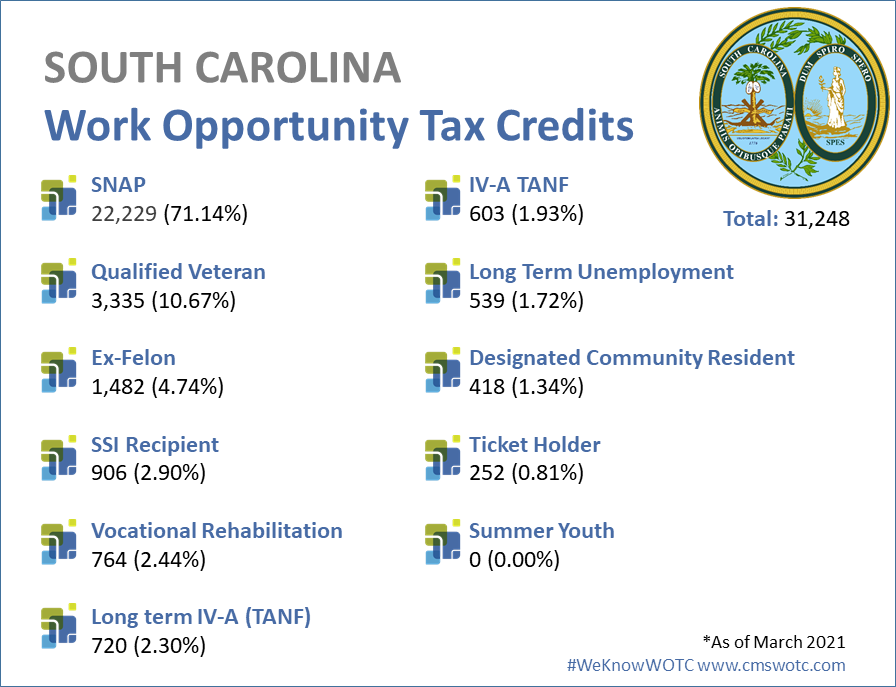

Work Opportunity Tax Credit Statistics for South Carolina

In 2020 the state of South Carolina issued 31,248 Work Opportunity Tax Credit certifications. South Carolina issued 1.93% of all WOTC Tax Credits in 2020, SNAP was South Carolina’s highest tax credit category with 71.14% of certifications for that category.

Make the Switch to Paperless WOTC Screening

CMS has been providing Work Opportunity Tax Credit screening services for over 20 years. We have helped save employers millions of dollars that can be reinvested back into their businesses. We highly encourage customers to take advantage of the online WOTC screening form that we developed or the call center, both of which provide several benefits to you.

#ICYMI

-

- Your WOTC Dashboard

- Increased Integration for WOTC Tax Credit to iRecruit, Applicant Tracking Software

- Work Opportunity Tax Credit By The Numbers 2020

- EEOC Issues Formal Opinion on the Work Opportunity Tax Credit

- Important Notice: URL Changes for Online WOTC Forms

- Four Things You Didn’t Know About the Work Opportunity Tax Credit

- WOTC’s Target Groups

- Calculate your WOTC Savings

#Follow CMS on Social Media

#WeKnowWOTC

The latest news on the Work Opportunity Tax Credit (WOTC) from Cost Management Services. Sign Up for the Work Opportunity Tax Credit (WOTC) Newsletter

Related: WOTC Newsletter Archive