CMS Work Opportunity Tax Credit Newsletter July 2020

In this issue:

- SourceCast Selects CMS as its Work Opportunity Tax Credit Provider

- Senator Tammy Baldwin Introduces the Jobs for Economic Recovery Act, includes an Employee Retention Tax Credit based on the Work Opportunity Tax Credit (WOTC)

- CMS Adds Increased Integration for WOTC Tax Credit to iRecruit, Applicant Tracking Software

- Understanding WOTC’s Target Groups: Vocational Rehabilitation Referral

- Work Opportunity Tax Credit Statistics for Michigan

- WOTC Questions: Do Training Hours Count Towards WOTC Credit?

- Switch To Paperless WOTC Screening Today

- #ICYMI

SourceCast Selects CMS as its Work Opportunity Tax Credit Provider

Cost Management Services (CMS) is excited to announce that we have partnered with SourceCast, Inc. to help their customers capture and take advantage of the Work Opportunity Tax Credit. SourceCast is a leading provider of diversity sourcing for employers, talent sources and job seekers nationwide.

Senator Tammy Baldwin Introduces the Jobs for Economic Recovery Act, includes an Employee Retention Tax Credit based on the Work Opportunity Tax Credit (WOTC)

U.S. Senator Tammy Baldwin (D-WI) last week introduced legislation (PDF) to support the economic recovery by immediately financing six months of wages and benefits for unemployed workers. Baldwin is leading this effort with Senate Finance Committee Ranking Member Ron Wyden (D-OR) and Senators Chris Van Hollen (D-MD), Michael F. Bennet (D-CO) and Cory A. Booker (D-NJ). The bill creates an Employee Retention Tax Credit based on the Work Opportunity Tax Credit (WOTC) for employers who retain workers hired through the program for 24 months.

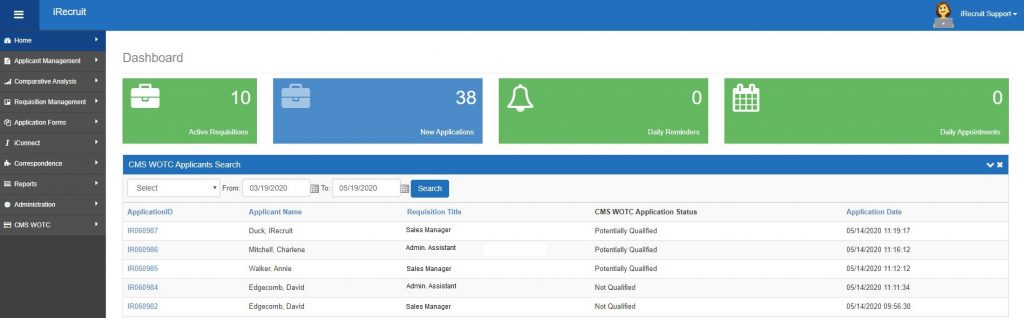

CMS Adds Increased Integration for WOTC Tax Credit to iRecruit, Applicant Tracking Software

We are pleased to announce that we have added increased Work Opportunity Tax Credit integration into iRecruit. The integration is immediately available for customers who use both iRecruit and CMS’s Work Opportunity Tax Credit Administration services.

Understanding WOTC’s Target Groups: Vocational Rehabilitation Referral

New hires who fall under one or more of WOTC’s Target Groups may make you eligible for a WOTC Tax Credit. Target Group #5 is the Vocational Rehabilitation Referral.

A “vocational rehabilitation referral” is a person who has a physical or mental disability and has been referred to the employer while receiving or upon completion of rehabilitative services pursuant to:

- A state plan approved under the Rehabilitation Act of 1973 OR

- An Employment Network Plan under the Ticket to Work program, OR

- A program carried out under the Department of Veteran Affairs.

Work Opportunity Tax Credit Statistics for Michigan

In 2019 the state of Michigan issued 113,807 Work Opportunity Tax Credit certifications. Nationwide Michigan issued 5.5% of WOTC Tax Credits in 2019. Michigan was also one of four states that issued over 100,000 WOTC certifications. Vocational Rehabilitation was the second highest target group in Michgan, issuing 31,79 credits or 27% of the total.

WOTC Questions: Do Training Hours Count Towards WOTC Credit?

CMS Says: If the training hours are paid, yes, they will count towards your WOTC total when calculating how many hours worked, and wages received by the employee.

Switch to Paperless WOTC Screening Today

CMS has been providing Work Opportunity Tax Credit screening services for over 20 years. We have helped save employers millions of dollars that can be reinvested back into their businesses. We highly encourage customers to take advantage of the online WOTC screening form that we developed or the call center, both of which provide several benefits to you.

#ICYMI

-

- Your WOTC Dashboard

- How to Check if You are in an Empowerment Zone, Enterprise Zone, or Rural Renewal County

- Work Opportunity Tax Credit By The Numbers 2019

- EEOC Issues Formal Opinion on the Work Opportunity Tax Credit

- Tips to Maximize WOTC Participation and Increase Savings in 2020

- WOTC’s 28-Day Rule Explained

- WOTC’s Target Groups

- Calculate your WOTC Savings

#Follow CMS on Social Media

#WeKnowWOTC

The latest news on the Work Opportunity Tax Credit (WOTC) from Cost Management Services. Sign Up for the Work Opportunity Tax Credit (WOTC) Newsletter

Related: WOTC Newsletter Archive