>

CMS Work Opportunity Tax Credit Newsletter March 2023

In this issue:

- Why Switch to a Paperless WOTC Screening Process

- Empowerment Zones, Enterprise Zones, Rural Renewal Counties Map

- What Can My WOTC Dashboard Show Me?

- WOTC Wednesday: How far back can we look back for Work Opportunity Tax Credits?

- Understanding WOTC’s Target Groups: Ex-Felon

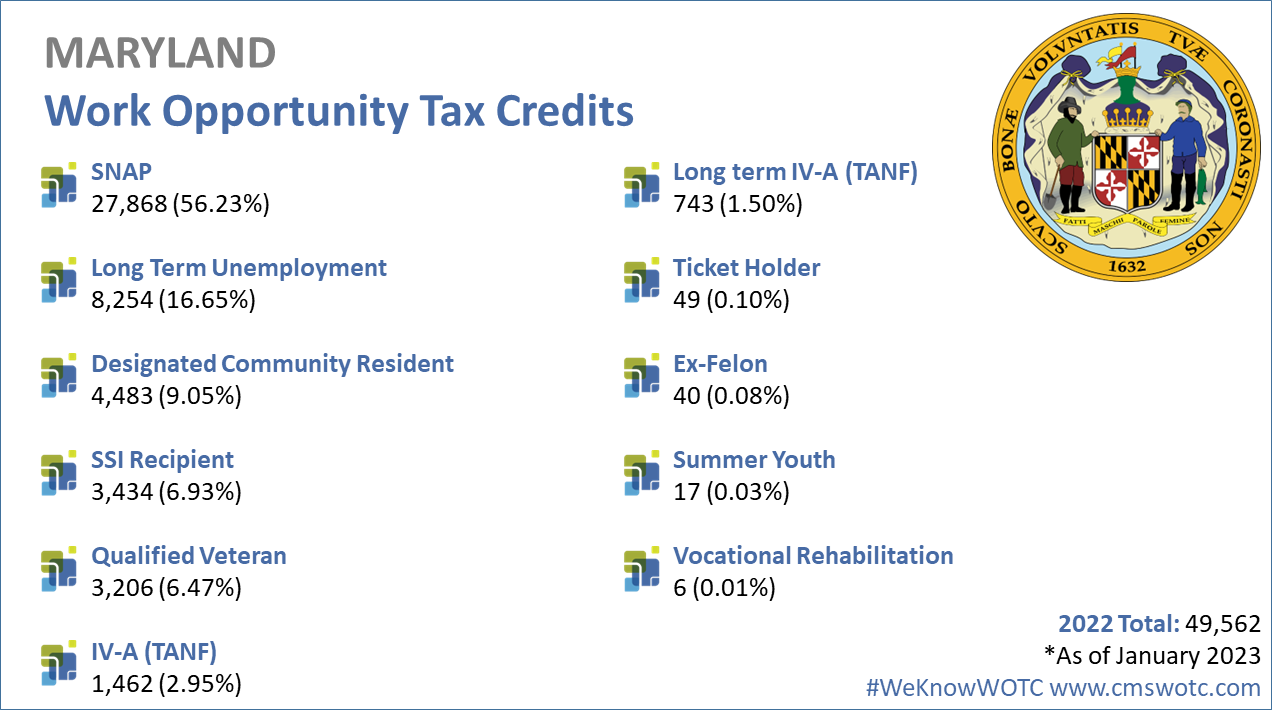

- Work Opportunity Tax Credit Statistics for Maryland

- #ICYMI

Why Switch to a Paperless WOTC Screening Process

CMS’s online web link screening system screens your WOTC new hires with ease. The benefits of using the online screening system include…

Empowerment Zones, Enterprise Zones, Rural Renewal Counties Map

If your employee lives in an Empowerment Zone, Enterprise Zone, or a Rural Renewal County and are between ages 18-39 you may be eligible for a WOTC Tax Credit. CMS’s online screening automatically includes an address check to determine if the employee resides in one of these zones. You can also check using CMS’s map on our website.

What Can My WOTC Dashboard Show Me?

Your Work Opportunity Tax Credit (WOTC) Dashboard gives you a real-time overview of the activity in your account. The Dashboard contains the following.

WOTC Wednesday: How far back can we look back for Work Opportunity Tax Credits?

CMS’s Brian Kelly answers your questions about the Work Opportunity Tax Credit in our weekly video Q&A series #WOTCWednesday.

Other Recent #WOTCWednesday Questions Answered:

- Can you do the WOTC Application on a Mobile Phone?

- Use Paper or Go Online with the WOTC Forms, Which is Better?

- How Are the Work Opportunity Tax Credits Calculated?

Submit your question for Brian here.

Understanding WOTC’s Target Groups: Ex-Felon

New hires who fall under one or more of WOTC’s Target Groups may make you eligible for a WOTC Tax Credit. Target Group #3 is the Ex-Felon. 73,809 individuals were hired with certification from this group in 2022, 2.87% of the total.

A “qualified ex-felon” is a person hired within a year of:

- Being convicted of a felony or

- Being released from prison for the felony

North Carolina hired the most Ex-Felons last year with 7,681 new hires qualifying under that target group. The maximum tax credit for hiring a qualified Ex-Felon is $2,400.

Work Opportunity Tax Credit Statistics for Maryland

In 2022 the state of Maryland issued 49,562 Work Opportunity Tax Credit certifications. Maryland issued 1.93% of all WOTC Tax Credits in 2022, SNAP Recipient was Maryland’s highest tax credit target group with 56.23% of certifications for that category. See historical data on Maryland and the Work Opportunity Tax Credit.

#ICYMI

#Follow CMS on Social Media

#WeKnowWOTC

The latest news on the Work Opportunity Tax Credit (WOTC) from Cost Management Services. Sign Up for the Work Opportunity Tax Credit (WOTC) Newsletter

Related: WOTC Newsletter Archive