CMS Work Opportunity Tax Credit Newsletter August 2022

In this issue:

- Introducing CMS Pin Point WOTC Technology (CPPT)

- WOTC In the News

- WOTC Wednesday: Does Your Software Check the Status of WOTC Applications?

- Understanding WOTC’s Target Groups: Summer Youth Employee

- Work Opportunity Tax Credit Statistics for Oregon

- Make the Switch To Paperless WOTC Screening

- #ICYMI

Introducing CMS Pin Point WOTC Technology (CPPT)

CMS’s Pin Point WOTC Technology (CPPT) performs a multi-step process to detect, identify and confirm new hires living in Federal Empowerment Zones and Rural Renewal Communities. CMS provides another technology tool designed to maximize the federal tax credit program for our clients.

WOTC In the News

- Tax credit proposed to encourage employers to hire more military spouses (13News Now)

- Rep. Don Beyer (D-VA) Assumes Sponsorship Of Bipartisan Military Spouse Hiring Act. The bill would amend the Workforce Opportunity Tax Credit to provide tax incentives to employers that hire the spouses of members of the United States Armed Forces, who face a much higher unemployment rate than the general population.

WOTC Wednesday: Does Your Software Check the Status of WOTC Applications?

CMS’s Brian Kelly answers your questions about the Work Opportunity Tax Credit in our weekly video Q&A series #WOTCWednesday.

Other Recent #WOTCWednesday Questions Answered:

- What are the benefits of Switching to Paperless WOTC Screening?

- Can I Rehire a Qualified WOTC Applicant to Meet the 28 Day Rule?

- Is the Summer Youth Category Still Around? (see below)

Submit your question for Brian here.

Understanding WOTC’s Target Groups: Summer Youth Employee

New hires who fall under one or more of WOTC’s Target Groups may make you eligible for a WOTC Tax Credit. Target Group #8 is the Summer Youth Employee. 1,561 individuals were hired with certification from this group in 2021, 0.07% of the total.

A “qualified summer youth employee” is one who:

- Is at least 16 years old, but under 18 on the date of hire or on May 1, whichever is later, AND

- Is only employed between May 1 and September 15 (was not employed prior to May 1) AND

- Resides in an Empowerment Zone (EZ), enterprise community or renewal community.

The maximum tax credit available for hiring a Summer Youth Employee is $1,200 (40% of $3,000 first-year wages). Texas hired the most Summer Youth Employees last year with 488.

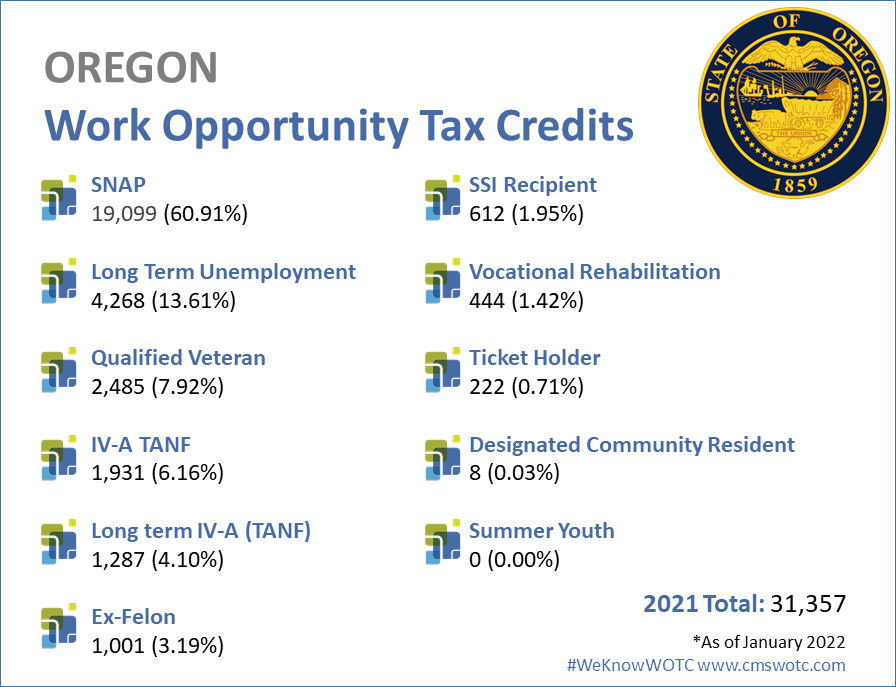

Work Opportunity Tax Credit Statistics for Oregon

In 2021 the state of Oregon issued 31,357 Work Opportunity Tax Credit certifications. The Beaver State issued 1.51% of all WOTC Tax Credits in 2021, SNAP Recipient was Oregon’s highest tax credit category with 60.91% of certifications for that target group.

Make the Switch to Paperless WOTC Screening

CMS has been providing Work Opportunity Tax Credit screening services for 25 years. We have helped save employers millions of dollars that can be reinvested back into their businesses. We highly encourage customers to take advantage of the online WOTC screening form that we developed or the call center, both of which provide several benefits to you.

#ICYMI

#Follow CMS on Social Media

#WeKnowWOTC

The latest news on the Work Opportunity Tax Credit (WOTC) from Cost Management Services. Sign Up for the Work Opportunity Tax Credit (WOTC) Newsletter

Related: WOTC Newsletter Archive