CMS Work Opportunity Tax Credit Newsletter January 2022

In this issue:

- New Spanish Language Option Available Online

- Top 10 Work Opportunity Tax Credit Blog Posts of 2021

- WOTC Wednesday: Is it Worth it to Use the Work Opportunity Tax Credit?

- Understanding WOTC’s Target Groups: Supplemental Nutrition Assistance Program (SNAP) Recipient

- Work Opportunity Tax Credit Statistics for Kentucky

- Switch To Paperless WOTC Screening

- #ICYMI

New WOTC Spanish Language Option Available Online

There is a new Spanish language option available on the online Work Opportunity Tax Credit screening form. To switch to Spanish, applicants can simply click on the link at the top of the page “Haga clic aquí para traducir al espñol” (“Click here to translate to Spanish”). This will allow them to complete the screening completely in Spanish. As we all know, there is a higher success rate when applicants can easily understand the questions being asked.

Top 10 Work Opportunity Tax Credit Blog Posts of 2021

A look back at our top blog posts of the last year.

WOTC Wednesday: Is it Worth it to Use the Work Opportunity Tax Credit?

CMS’s Brian Kelly answers your questions about the Work Opportunity Tax Credit in our weekly video Q&A series #WOTCWednesday.

Other Recent WOTC Questions Answered:

- WOTC Wednesday: Is There a Limit to How Many WOTC Tax Credits I Can Claim Each Year?

- WOTC Wednesday: Is WOTC Applicable to Part Time Employees?

- WOTC Wednesday: Is There a Minimum Amount of Hours Employee Needs to Work for WOTC Eligibility?

Understanding WOTC’s Target Groups: Supplemental Nutrition Assistance Program (SNAP) Recipient

New hires who fall under one or more of WOTC’s Target Groups may make you eligible for a WOTC Tax Credit. Target Group #1 is the Supplemental Nutrition Assistance Program (SNAP) Recipient. 1.1 million individuals were hired with certification from this group in 2020, 68% of the total, making it the top overall certified category.

A “qualified SNAP benefits recipient” is an individual who on the date of hire is:

- At least 18 years old

- under 40, AND

- A member of a family that received SNAP benefits for:

- the previous 6 months OR

- at least 3 of the previous 5 months.

The maximum tax credit available for hiring a Supplemental Nutrition Assistance Program (SNAP) Recipient is $2,400

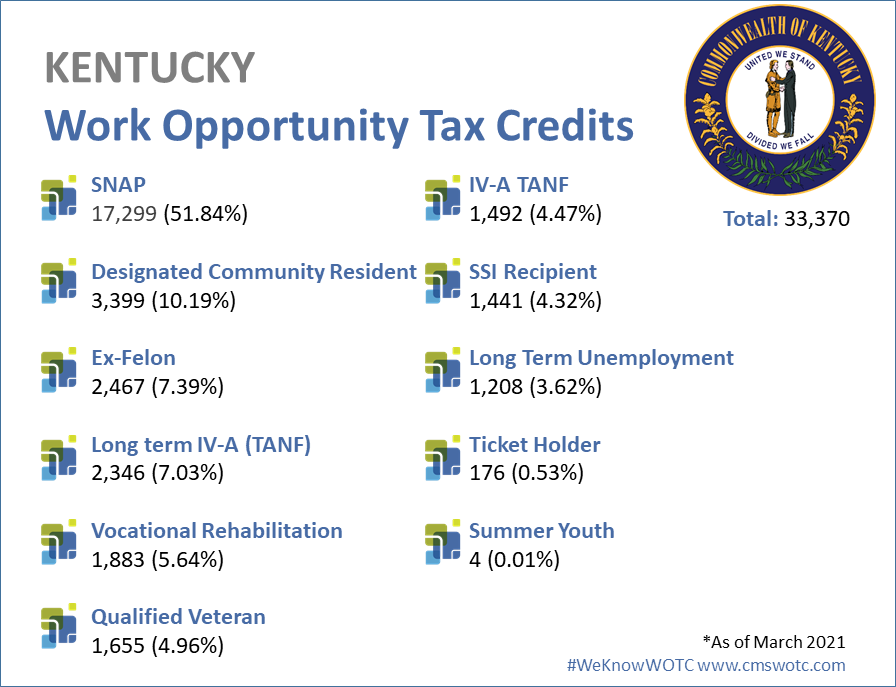

Work Opportunity Tax Credit Statistics for Kentucky

In 2020 the state of Kentucky issued 33,370 Work Opportunity Tax Credit certifications. The Bluegrass State issued 2.06% of all WOTC Tax Credits in 2020, SNAP was Kentucky’s highest tax credit category with 51.84% of certifications for that category.

Switch to Paperless WOTC Screening

CMS has been providing Work Opportunity Tax Credit screening services for 25 years. We have helped save employers millions of dollars that can be reinvested back into their businesses. We highly encourage customers to take advantage of the online WOTC screening form that we developed or the call center, both of which provide several benefits to you.

#ICYMI

-

- Your WOTC Dashboard

- Increased Integration for WOTC Tax Credit to iRecruit, Applicant Tracking Software

- Work Opportunity Tax Credit By The Numbers 2020

- EEOC Issues Formal Opinion on the Work Opportunity Tax Credit

- Important Notice: URL Changes for Online WOTC Forms

- Four Things You Didn’t Know About the Work Opportunity Tax Credit

- WOTC’s Target Groups

- Calculate your WOTC Savings

#Follow CMS on Social Media

#WeKnowWOTC

The latest news on the Work Opportunity Tax Credit (WOTC) from Cost Management Services. Sign Up for the Work Opportunity Tax Credit (WOTC) Newsletter

Related: WOTC Newsletter Archive