CMS Work Opportunity Tax Credit Newsletter August 2021

In this issue:

- How to Check if You are in an Empowerment Zone, Enterprise Zone, or Rural Renewal County

- The EEOC Formal Opinion on the Work Opportunity Tax Credit

- How to Make WOTC a Part of Your Onboarding Process

- WOTC Wednesday: Is it Worth it to do the Work Opportunity Tax Credit?

- Understanding WOTC’s Target Groups: Supplemental Security Income (SSI) Recipient

- Work Opportunity Tax Credit Statistics for Texas

- Reminder to Customers: Send WOTC Surveys Within 28 Days of Employee’s Start Date

- Switch To Paperless WOTC Screening in 2021

- #ICYMI

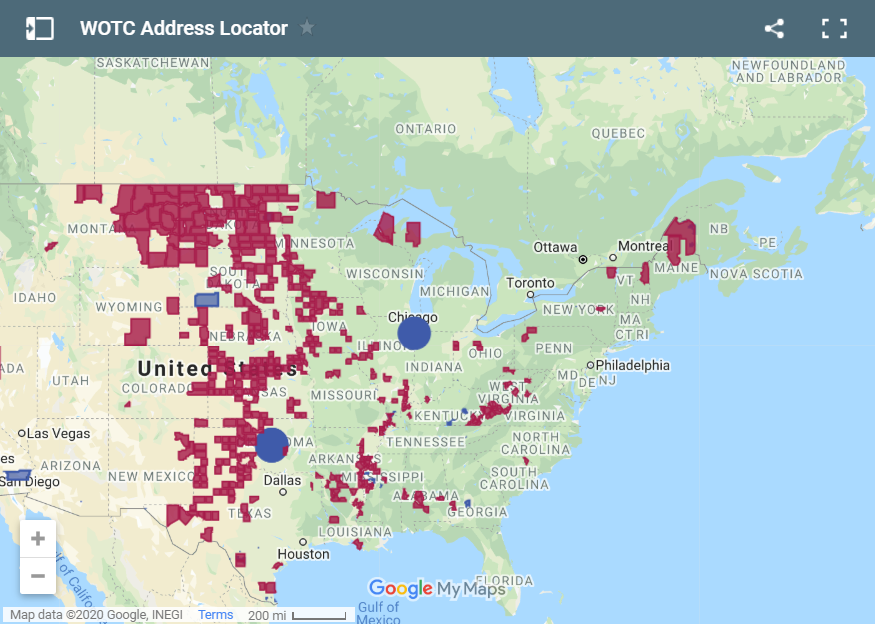

How to Check if You are in an Empowerment Zone, Enterprise Zone, or Rural Renewal County

If your new employees live in an Empowerment Zone, Enterprise Zone, or Rural Renewal Community (RRC) you may be eligible for a WOTC Tax Credit. Click on the map to zoom in and find out if your location qualifies.

The EEOC Formal Opinion on the Work Opportunity Tax Credit

The U.S. Equal Employment Opportunity Commission released its first official opinion letter on the Federal Work Opportunity Tax Credit Form 8850. The letter confirms that employers can legally utilize the Work Opportunity Tax Credit without violating federal anti-discrimination laws.

How to Make WOTC a Part of Your Onboarding Process

Adding WOTC to your onboarding process with new hires is simple. We offer 3 easy ways to include WOTC as part of your new hire “paperwork,” you can use one option, or a combination of all three, depending on your needs.

WOTC Wednesday: Is it Worth it to do the Work Opportunity Tax Credit?

CMS’s Brian Kelly answers your questions about the Work Opportunity Tax Credit in our new weekly video Q&A series #WOTCWednesday.

Other Recent WOTC Questions Answered:

- Is There a Best Practice to Making Sure Employees Participate in WOTC Screening?

- Can I Switch to an Online WOTC Process from Paper?

- Is There Any Way to Still Qualify for WOTC If Employee Was Hired Over 28 Days Ago?

Understanding WOTC’s Target Groups: Supplemental Security Income (SSI) Recipient

New hires who fall under one or more of WOTC’s Target Groups may make you eligible for a WOTC Tax Credit. Target Group #8 is the Supplemental Security Income (SSI) Recipient. 60,948 individuals were hired with certification from this group in 2020, 3.76% of the total. An individual is a “qualified SSI recipient” if a month for which this person received SSI benefits is within 60 days of the date this person is hired. To receive SSI, you must be disabled, blind, or at least 65 years old and have “limited” income and resources.

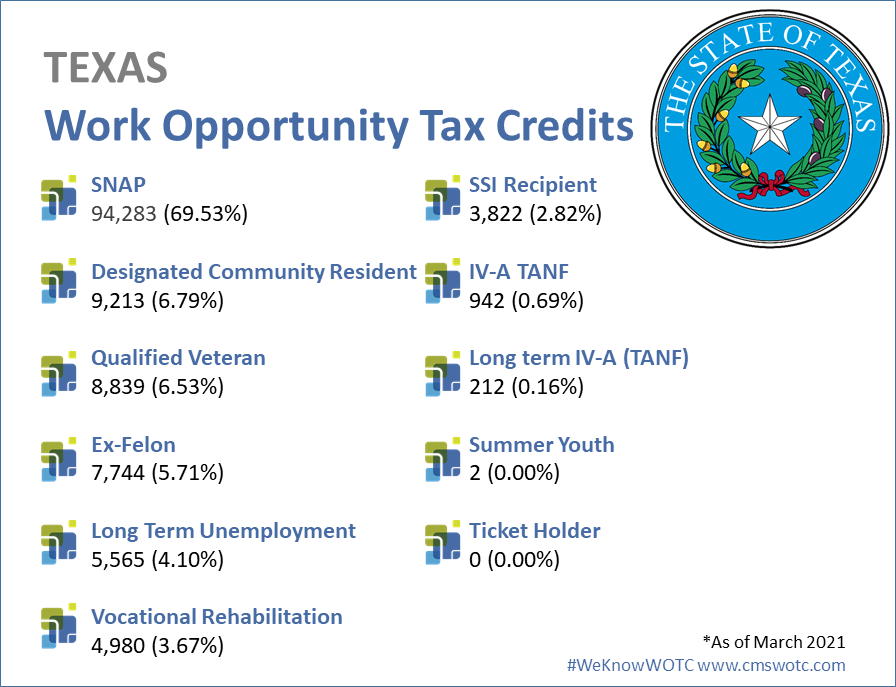

Work Opportunity Tax Credit Statistics for Texas

In 2020 the state of Texas issued 135,602 Work Opportunity Tax Credit certifications. Texas issued 8.37% of all WOTC Tax Credits in 2020, and the most overall. SNAP was Texas’s highest tax credit category with 69.5% of certifications for that category.

Reminder to Customers: Send WOTC Surveys Within 28 Days of Employee’s Start Date

Because of the WOTC 28 Day Rule CMS has just 28 days from the employee’s start date to submit your forms to the respective state agency for processing. The 3 week suggestion is to make sure our team of administrators has time to screen and process your WOTC applications.

Switch to Paperless WOTC Screening in 2021

CMS has been providing Work Opportunity Tax Credit screening services for over 20 years. We have helped save employers millions of dollars that can be reinvested back into their businesses. We highly encourage customers to take advantage of the online WOTC screening form that we developed or the call center, both of which provide several benefits to you.

#ICYMI

-

- Your WOTC Dashboard

- Increased Integration for WOTC Tax Credit to iRecruit, Applicant Tracking Software

- Work Opportunity Tax Credit By The Numbers 2020

- EEOC Issues Formal Opinion on the Work Opportunity Tax Credit

- Important Notice: URL Changes for Online WOTC Forms

- WOTC’s 28-Day Rule Explained

- WOTC’s Target Groups

- Calculate your WOTC Savings

#Follow CMS on Social Media

#WeKnowWOTC

The latest news on the Work Opportunity Tax Credit (WOTC) from Cost Management Services. Sign Up for the Work Opportunity Tax Credit (WOTC) Newsletter

Related: WOTC Newsletter Archive