CMS Work Opportunity Tax Credit Newsletter July 2021

In this issue:

- Best Practices to Making Sure Employees Participate

- Reminder to Customers: Send WOTC Surveys Within 28 Days of Employee’s Start Date

- Don’t Miss Out On Potential WOTC Tax Credits

- WOTC Wednesday: How do I Explain Why We Are Asking If the Employee Has Received SNAP/Food Stamps?

- Understanding WOTC’s Target Groups: Supplemental Nutrition Assistance Program (SNAP) Recipient

- Work Opportunity Tax Credit Statistics for Michigan

- Switch To Paperless WOTC Screening in 2021

- #ICYMI

Best Practices to Making Sure Employees Participate

Consistency is a key factor in getting new hires to complete the WOTC “paperwork”. We recommend the following steps: 1. Include WOTC with all of your new hire paperwork so that it appears like it is required.

Reminder to Customers: Send WOTC Surveys Within 28 Days of Employee’s Start Date

Because of the WOTC 28 Day Rule CMS has just 28 days from the employee’s start date to submit your forms to the respective state agency for processing. The 3 week suggestion is to make sure our team of administrators has time to screen and process your WOTC applications.

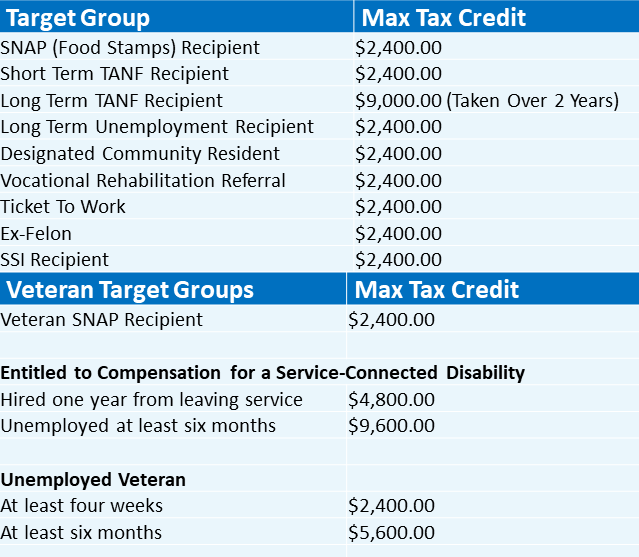

Don’t Miss Out On Potential WOTC Tax Credits

We want to make sure every new hire you bring aboard is being screened. Above is a small graphic to show what the target groups are for WOTC and their potential max credit amount.

WOTC Wednesday: How do I Explain Why We Are Asking If the Employee Has Received SNAP/Food Stamps?

CMS’s Brian Kelly answers your questions about the Work Opportunity Tax Credit in our new weekly video Q&A series #WOTCWednesday.

Other Recent WOTC Questions Answered:

- Can I Still Get a WOTC Tax Credit if my Employee Only Worked for Two Weeks?

- What Is a Conditional Certification for WOTC?

- Can You Do the WOTC Application on a Cell Phone?

Understanding WOTC’s Target Groups: Supplemental Nutrition Assistance Program (SNAP) Recipient

New hires who fall under one or more of WOTC’s Target Groups may make you eligible for a WOTC Tax Credit. Target Group #7 is the Supplemental Nutrition Assistance Program (SNAP) Recipient. As the continuously largest qualifying category for WOTC, 1,106,756 individuals were hired with certification from this group in 2020. There are currently 42 million individuals who receive SNAP benefits in the United States.

A “qualified SNAP benefits recipient” is an individual who on the date of hire is:

- At least 18 years old and under 40, AND

- A member of a family that received SNAP benefits for:

- the previous 6 months OR

- at least 3 of the previous 5 months.

Note, “SNAP” is also a part of the Qualified Veteran target group.

Work Opportunity Tax Credit Statistics for Michigan

In 2020 the state of Michigan issued 60,276 Work Opportunity Tax Credit certifications. Michigan issued 3.72% of all WOTC Tax Credits in 2020. SNAP was Michigan’s highest tax credit category with 70.8% of certifications for that category.

Switch to Paperless WOTC Screening in 2021

CMS has been providing Work Opportunity Tax Credit screening services for over 20 years. We have helped save employers millions of dollars that can be reinvested back into their businesses. We highly encourage customers to take advantage of the online WOTC screening form that we developed or the call center, both of which provide several benefits to you.

#ICYMI

-

- Your WOTC Dashboard

- Increased Integration for WOTC Tax Credit to iRecruit, Applicant Tracking Software

- Work Opportunity Tax Credit By The Numbers 2020

- EEOC Issues Formal Opinion on the Work Opportunity Tax Credit

- Important Notice: URL Changes for Online WOTC Forms

- WOTC’s 28-Day Rule Explained

- WOTC’s Target Groups

- Calculate your WOTC Savings

#Follow CMS on Social Media

#WeKnowWOTC

The latest news on the Work Opportunity Tax Credit (WOTC) from Cost Management Services. Sign Up for the Work Opportunity Tax Credit (WOTC) Newsletter

Related: WOTC Newsletter Archive