CMS Work Opportunity Tax Credit Newsletter May 2021

In this issue:

- Reintroduction of the Military Spouse Hiring Act

- Empowerment Zones, Enterprise Zones, Rural Renewal Counties Map

- EEOC Formal Opinion on the Work Opportunity Tax Credit

- How Are We Doing? Please Take Our Customer Survey

- WOTC Wednesday: What Are the Benefits of Going Paperless with WOTC Screening?

- Understanding WOTC’s Target Groups: Vocational Rehabilitation Referral

- Work Opportunity Tax Credit Statistics for Pennsylvania

- Switch To Paperless WOTC Screening in 2021

- #ICYMI

Reintroduction of the Military Spouse Hiring Act

Representative Antonio Delgado (NY-19) has reintroduced the Military Spouse Hiring Act, a bipartisan legislation that incentivizes employers to hire spouses of members of the United States Armed Forces. The bill would expand the Work Opportunity Tax Credit to include the hiring of qualified military spouses.

Empowerment Zones, Enterprise Zones, Rural Renewal Counties Map

If your new employee lives in an Empowerment Zone, Enterprise Zone, or a Rural Renewal County and are between ages 18-39 you may be eligible for a WOTC Tax Credit. CMS’s screening automatically includes an address check to determine if the employee resides in one of these zones. You can also check using CMS’s map on our website.

EEOC Formal Opinion on the Work Opportunity Tax Credit

Last year the U.S. Equal Employment Opportunity Commission has released its first official opinion letter on the Federal Work Opportunity Tax Credit Form 8850. The letter confirms that employers can legally utilize the Work Opportunity Tax Credit without violating federal anti-discrimination laws.

How Are We Doing? Please Take Our Customer Survey

At CMS we strive to do better and implement new features that help our clients. We would love to get your feedback on how we’re doing, and how we might improve. If you have a few minutes, please complete our survey.

WOTC Wednesday: What Are the Benefits of Going Paperless with WOTC Screening?

CMS’s Brian Kelly answers your questions about the Work Opportunity Tax Credit in our new weekly video Q&A series #WOTCWednesday.

Other Recent WOTC Questions Answered:

Understanding WOTC’s Target Groups: Vocational Rehabilitation Referral

New hires who fall under one or more of WOTC’s Target Groups may make you eligible for a WOTC Tax Credit. Target Group #5 is the Vocational Rehabilitation Referral. 29,316 individuals were hired with certification from this group in 2020.

A “vocational rehabilitation referral” is a person who has a physical or mental disability and has been referred to the employer while receiving or upon completion of rehabilitative services pursuant to:

- A state plan approved under the Rehabilitation Act of 1973 OR

- An Employment Network Plan under the Ticket to Work program, OR

- A program carried out under the Department of Veteran Affairs.

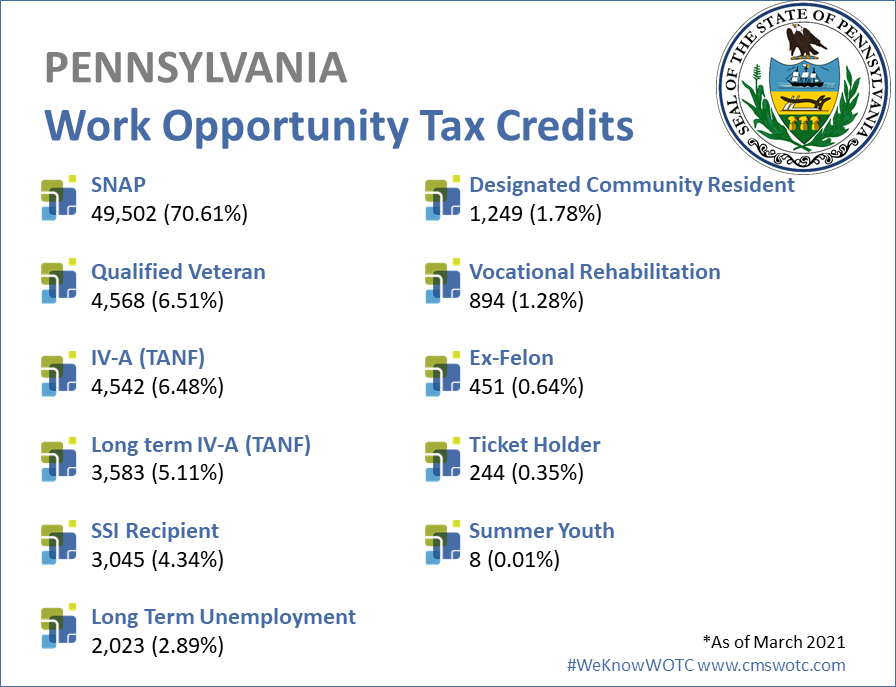

Work Opportunity Tax Credit Statistics for Pennsylvania

In 2020 the state of Pennsylvania issued 70,109 Work Opportunity Tax Credit certifications. Nationwide the keystone state issued 4.33% of all WOTC Tax Credits in 2020. SNAP was Pennsylvania’s highest tax credit category with 70.61% of certifications for that category.

Switch to Paperless WOTC Screening in 2021

CMS has been providing Work Opportunity Tax Credit screening services for over 20 years. We have helped save employers millions of dollars that can be reinvested back into their businesses. We highly encourage customers to take advantage of the online WOTC screening form that we developed or the call center, both of which provide several benefits to you.

#ICYMI

-

- Your WOTC Dashboard

- Increased Integration for WOTC Tax Credit to iRecruit, Applicant Tracking Software

- Work Opportunity Tax Credit By The Numbers 2019

- EEOC Issues Formal Opinion on the Work Opportunity Tax Credit

- Important Notice: URL Changes for Online WOTC Forms

- WOTC’s 28-Day Rule Explained

- WOTC’s Target Groups

- Calculate your WOTC Savings

#Follow CMS on Social Media

#WeKnowWOTC

The latest news on the Work Opportunity Tax Credit (WOTC) from Cost Management Services. Sign Up for the Work Opportunity Tax Credit (WOTC) Newsletter

Related: WOTC Newsletter Archive