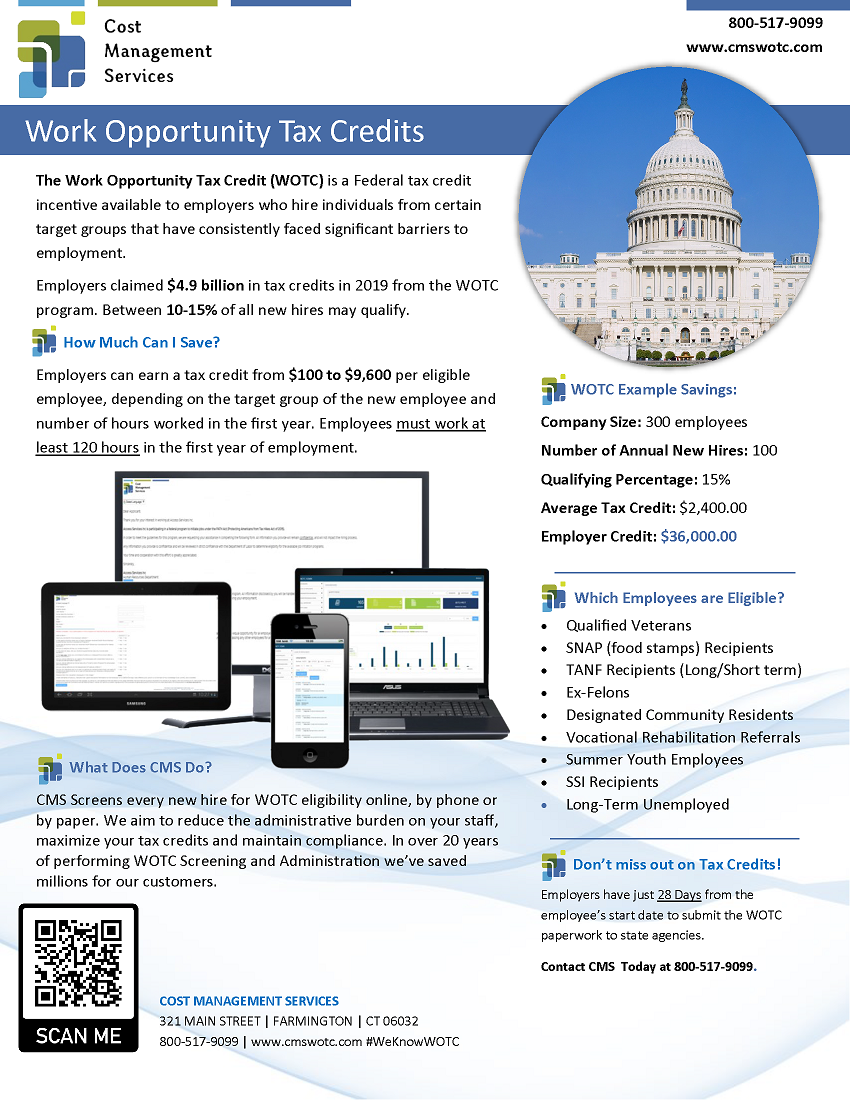

Cost Management Services has been working with employers for over 20 years to save money by taking advantage of the CMS Work Opportunity Tax Credit Program.

Based on CMS’ experience 10-15% of the workforce is eligible for the employment tax credits. Why aren’t you taking advantage? Click here to calculate your potential savings! Call CMS today at 1-800-517-9099.

We do all the work for you

Get a bonus for your company, while helping others. CMS will provide your organization with the tools to maximize the WOTC tax incentives. In addition CMS will provide the following benefits:

- CMS will identify eligible employees.

- CMS understands all the Federal and State guidelines for your company to obtain the eligible tax credits.

- CMS handles all the administrative duties necessary to obtain WOTC in your state.

- CMS protects your organization from asking the sensitive questions necessary to obtain the WOTC tax credits.

Which Employees Are Eligible for a WOTC Tax Credit?

WOTC applies to new employees hired before December 31, 2020.

- Qualified Veteran. (only current active program)

- Long-term TANF Recipient.

- Short-term TANF Recipient.

- Supplemental Nutrition Assistance Program (SNAP) Recipient.

- Designated Community Resident.

- Vocational Rehabilitation Referral.

- Ex-Felon.

- SSI Recipient.

For more information please call CMS at 1-800-517-9099 or visit our website at: www.cmswotc.com